At Prosperity Planning, we’ve been serving pre-retirees, business owners, divorcees, and high-income women for nearly 20 years. Based in Kansas City, MO, we are a Registered Investment Advisor providing personalized Prosperity Planning Blueprints™ for clients throughout the Kansas City, MO region.

The Prosperity Planning Blueprint™ is our process to uncover each client’s financial opportunities and obstacles so they can achieve their vision for prosperity. This means embracing our fiduciary obligation to serve clients’ best interest, offering advice that is objective, and making fees transparent.

It also means upholding our responsibilities as NAPFA-registered, fee-only financial advisors. NAPFA—short for the National Association of Personal Financial Advisors—requires its members to put clients first. To that end, we do not sell products, and we are paid by clients for our comprehensive advice and expertise—no third parties ever provide us commissions or other compensation.

Our responsibility to serve clients’ best interests isn’t limited to certain services or investment accounts—we put our clients first in everything we do. Always.

NAPFA Requirements

NAPFA’s mission is to be a standard bearer for client-centered, fee-only, fiduciary advisors. NAPFA’s members must adhere to the organization’s standards. You can read about these standards in more depth on the NAPFA website, but here they are briefly:

- Fee-only: A fee-only NAPFA member is compensated by clients only. Neither the advisor nor any related parties can receive compensation that depends on the buying or selling of financial products.

- Prohibition: NAPFA advisors cannot own or be employed by a financial services firm that receives commissions, rebates, awards, or similar forms of compensation. Nor can any parties related to the advisor, such as business colleagues or family members who share income or economic benefits.

- Compliance: A NAPFA-registered advisor must abide by NAPFA’s code of ethics and other rules, as well as all federal and state regulations.

- Notification: Advisors must inform NAPFA, promptly and in writing, of any significant disciplinary and legal events.

Why such strict standards? When you entrust your wealth to a financial professional, you should know they will honor your trust. As NAPFA members, we believe that such stringent standards increase our clients’ trust in our advice, which is essential for our relationship.

How Fee-Only Financial Planning Helps You

If you talk to a variety of financial professionals about their fees, you’ll soon learn that they charge clients in different ways. Some of the terms that advisors use—like fee-only and fee-based—are similar enough that you may think they’re the same. But they aren’t, and it’s important that you know the difference.

The three basic ways financial professionals get compensated are:

- Fee-only: The advisor is paid by clients, much like an attorney or CPA is. The advisor receives no commissions or other third-party compensation.

- Commission-based: A third party, such as a big bank or investment company, pays the advisor for any products the client ends up buying.

- Fee-based: The advisor can get paid by the client and/or a third party.

We agree with NAPFA that the model that serves clients best is the fee-only one. When we partner with you, you can rest assured that our interests are aligned with yours rather than with a third party. We’re not swayed by the promise of a commission and can better maintain our fiduciary obligation to you.

But with an advisor who stands to get paid handsomely for the products you buy, how do you know whose interest they serve? Is there a better product for you that they neglected to tell you about since it wouldn’t earn them as big a commission?

Commission-based and fee-based models increase conflicts of interest. Always make sure you know how an advisor you are considering will get paid.

And what do the specifics of a fee-only model look like? It really depends on the advisor. Most, including our firm, charge a fee that is based on the percentage of assets they manage for you. Others may base their fees:

- By the hour

- Per project

- On a retainer

Some fee models work better in some situations than others. For example, if you want ongoing financial planning and investment management, you’ll be well-served by the assets-under-management model. If you want one-time advice, the hourly or project fee model may work for you.

Our Comprehensive Services

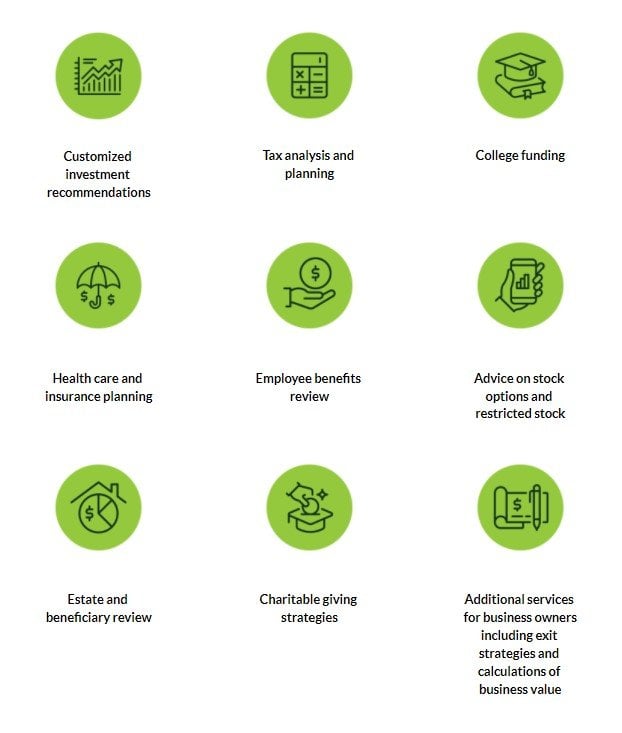

Our advisory team of NAPFA-registered financial advisors creates a custom Prosperity Planning Blueprint™ for each client. Working with you, we do a deep dive into what prosperity means for you, then create a blueprint of financial, tax, and investment strategies to help achieve it. Blueprint topic areas include:

Want to Learn More About NAPFA?

Want to learn more about how a NAPFA-registered financial advisor can help you? The website for the National Association of Personal Financial Advisors has resources you may find useful.

- Use the About NAPFA page as a jumping-off point for the organization’s history, values, mission, code of ethics, and more.

- Use the Find an Advisor page to search for a NAPFA advisor in your geographic region. You can save your favorites and send the list to your email or printer.

- The Consumer Resources section contains great information, including questions to ask a potential advisor and what to do if you need pro-bono assistance through the NAPFA Consumer Education Foundation.

We also welcome answering any questions you may have about our membership or NAPFA in general.

Get Started

What does your Prosperity Planning Blueprint™ look like? Schedule a 30-minute discovery call to discuss your situation and how we may be able to help.

SCHEDULE A DISCOVERY CALL

Let’s discuss how your personalized Prosperity Planning Blueprint™ can reduce complexity, lower taxes, and lessen the responsibilities that come with success. Schedule a complimentary 30-minute call below.