We founded Prosperity Planning in 2004 so that we could help clients transform their success into prosperity. For us, prosperity meant financial freedom and peace of mind. It meant using our expertise to help Kansas City, MO residents optimize their finances and fulfill their dreams.

We’ve been committed to helping achieve prosperity for pre-retirees, business owners, divorcees, and high-income women since our founding. And essential to our mission is serving as a fee-only, fiduciary financial advisor.

Fee-only financial advisors don’t sell products and don’t accept commissions. Instead, they are paid by clients for the financial planning and investment management they provide.

Fiduciary financial advisors are obligated to put their clients’ best interests first—even before the advisors’ interests. This obligation isn’t limited to certain investment accounts or services. It applies to everything we do for you as a client.

We embrace our role as fee-only, fiduciary financial planners in Kansas City, MO. By helping to eliminate conflicts of interest, we can provide unbiased advice to help you reach your prosperity vision.

What Is a Fiduciary?

A fiduciary financial advisor is an advisor required to put your best interest first. It may surprise you that not all financial professionals are fiduciaries. After all, it’s your hard-earned wealth you are entrusting to the wealth manager. Shouldn’t they be obliged to manage it with loyalty and care for you?

The truth is that not all financial professionals must put you first. Depending on the advisor’s status, they may sometimes serve as a fiduciary and sometimes not. Often, these are financial providers who earn commissions or other third-party compensation.

If a financial provider stands to earn a commission for the product they pitch to you, whose interest are they serving? Yours, theirs, or the company giving them the bonus? You really can’t know.

The U.S. Securities and Exchange Commission, which regulates Registered Investment Advisors such as our firm, requires RIAs to be fiduciaries. But really, we wouldn’t have it any other way. We want long-term relationships with our clients, and trust is essential to that relationship. That’s why we serve as fiduciaries—so you know who we’re really serving: you.

The Suitability Standard

You will often find financial professionals acting under what’s called the suitability standard. This means they can give you advice that is “suitable” for your situation.

Contrast this with a fiduciary, whose advice must be in your best interest. The suitability standard allows the professional, such as a broker-dealer, to recommend an investment or insurance product that they deem suitable for you.

Say, in this case, they recommend a mutual fund. Now, the mutual fund may have higher fees than other similar funds, but in the broker’s judgment, it’s suitable for you. They don’t have to tell you about the alternatives. And if this mutual fund will earn them a big commission, a conflict of interest arises.

The government and the industry are grappling with this issue, and there has been a lot of back-and-forth in legislation. This makes it essential for you, as a consumer, to do your research into potential advisors.

Someone with a full-time obligation to advance your interests will take the time to understand your financial situation, strive to disclose all pertinent information, and tell you if their advice changes. The same can’t be said for financial providers who don’t have a continuous fiduciary obligation to you.

How to Tell Who Is a Fiduciary

So how do you tell if a financial professional or firm is a fiduciary?

Just ask them. Their response should be an unequivocal “yes.” Anything other than that probably means they are not.

You will want to talk to a potential financial planner at length about the fiduciary obligation they do have: Is it continuous or at the point of sale? Is it for all advice they provide or limited to certain areas, like retirement plans? Who else besides you will pay them? Will the advisor put their fiduciary obligation to you in writing?

In addition, ask for their Form ADV and Form CRS. These documents provide important information about the firm’s fee structure, conflicts of interests, disciplinary history, and other crucial information.

Find out the regulating agency. For example, the federal SEC or a state securities agency regulates Registered Investment Advisors. An SEC-regulated firm means they’ll have a fiduciary duty to you.

If they’re a broker-dealer, they’re regulated by the Financial Industry Regulatory Authority (FINRA). They aren’t required to be continuous fiduciaries, so you’ll want to interview a potential professional at length to make sure you understand when they serve your best interest and when they don’t.

You can confirm an RIA’s status on the SEC advisor lookup webpage and a broker-dealer’s status on FINRA’s BrokerCheck page.

Certain certifications also give you important information about fiduciary obligations. Advisors with the following designations must always give fiduciary advice:

- CERTIFIED FINANCIAL PROFESSIONAL™ (CFP®)

- Accredited Investment Fiduciary® (AIF®)

- Chartered Financial Consultant® (ChFC®)

Memberships in some professional organizations also indicate a fiduciary responsibility, among them:

- National Association of Personal Financial Advisors (NAPFA)

- Garrett Planning Network

- XY Planning Network

The above organizations also have search features on their websites so you can find a fiduciary advisor who is a member of that association.

Our Comprehensive and Fiduciary Services

We follow a structured process, the Prosperity Planning Blueprint™, to uncover your potential financial obstacles and opportunities. We then create your financial plan to mitigate the obstacles and take advantage of the opportunities—all while working toward your prosperity vision.

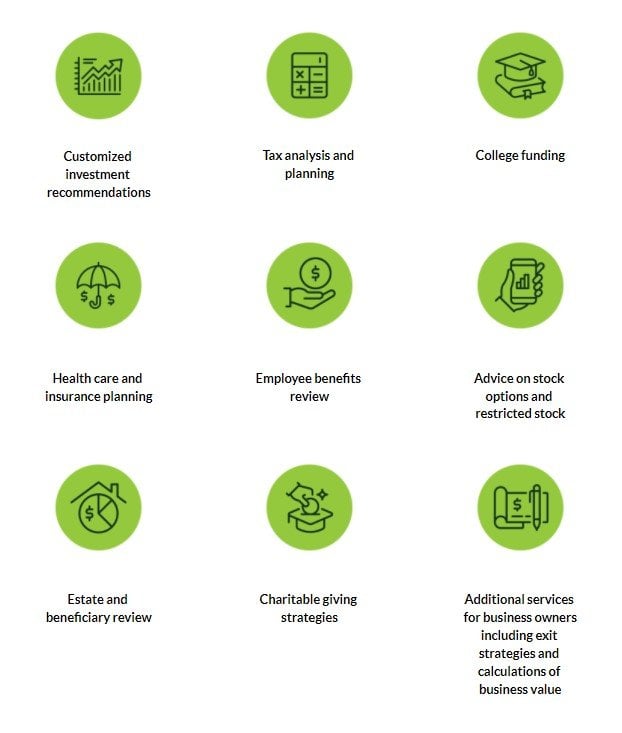

Our comprehensive topic areas include:

We support your personalized Prosperity Planning Blueprint™ with a fee-only model and fiduciary advice. We think our independence from third-party companies aligns our interests with yours even more.

Learn More About the Fiduciary Obligation

Here are articles to help you dig deeper into the importance of a fiduciary:

- Fiduciary 101 (NAPFA)

- Three Reasons Why “Fiduciary” Is Critical When Choosing a Financial Advisor (FeeOnlyNetwork.com)

- Fiduciary Duty: Your Best Interests Should Come First (letsmakeaplan.org)

- Financial Advisor Interview Questionnaire (Garrett Planning Network)

We also welcome any questions you may have about our role as fiduciary advisors.

Get Started

What does your Prosperity Planning Blueprint™ look like? Schedule a 30-minute discovery call to discuss your situation and how we may be able to help.

SCHEDULE A DISCOVERY CALL

Let’s discuss how your personalized Prosperity Planning Blueprint™ can reduce complexity, lower taxes, and lessen the responsibilities that come with success. Schedule a complimentary 30-minute call below.