We believe that the best financial advice you can receive is advice that puts you first. When you’re ready to entrust a financial professional with your hard-earned wealth, you need to know that the advice is objective without commissions attached.

Why no commissions? Because commissions and other third-party compensation can influence the advice that a financial planner gives. Rather than putting your interests first, the wealth manager may give you recommendations that earn them a bigger paycheck.

We embrace a different way at Prosperity Planning. Based in Kansas City, MO, we are a client-centered advisory firm serving pre-retirees, business owners, divorcees, and high-income women. Here, you won’t find a financial advisor selling you products or receiving compensation from another company. We are paid by you, our client, and we make sure you always know what you are paying for.

As a result, our advice is objective, and our fees are transparent. We are proud to be an independent, fee-only financial planning firm that puts our clients’ interests before our own.

As independent, fee-only financial advisors, we serve as financial advocates to all our clients in the Kansas City, MO region. By eliminating conflicts of interest, we can provide you unbiased advice meant to do one thing: help you reach your goals.

The Difference Between a Fee-Only and Fee-Based Financial Planner

In the financial services industry, you will find three main types of fee structures:

- Commission-based

- Fee-based

- Fee-only

The commission-based fee structure is self-explanatory. The financial or insurance professional stands to earn a commission for selling you a product, whether that’s an investment fund or an annuity.

The fee structures get murkier with fee-based and fee-only. There’s just a single word’s difference between the two terms, leading people to believe that the phrases are interchangeable.

They aren’t.

A fee-only advisor—like our firm—serves you much like your attorney does. You want an attorney’s advice, and you pay for their advice. The attorney isn’t paid by a third party for steering you toward a certain product. As fee-only financial advisors, we work the same way. You pay us for financial planning and investment management, and that’s what you receive. There are no products pushed on you.

A fee-based advisor is different. Sometimes you pay them; sometimes they get paid by a third party; sometimes it’s both. Sometimes they may be required to act as your fiduciary and give you advice that is in your best interest. Other times, they may adhere to the suitability standard—meaning they can sell you a product that’s “suitable” for you, even if it wasn’t the best product for your situation. Meanwhile, that suitable product earned them a commission.

We don’t mean to criticize commissioned or fee-based professionals. Many of them are hardworking, sincere, and want to see you succeed.

But we are criticizing that these distinctions exist to begin with. In our mind, clients should always come first. They are entrusting their wealth to us. And the best way to steward that wealth is to eliminate conflicts of interest and put the clients’ interests first.

The only fee structure designed for this is the fee-only one.

How Fee-Only Financial Planners Get Paid

It’s important that you understand the kinds of services you seek when you begin the process of looking for a financial advisor. Ask yourself:

- Am I just looking for someone to complete investment trades for me?

- Do I want an advisor to manage my investment portfolio so I don’t have to?

- Do I want specific or limited guidance in one area of my personal finances?

- Do I need a financial plan that I’ll implement on my own?

- Do I want a financial advisor to provide ongoing guidance in all areas of my wealth?

Knowing what you want will help you locate the financial professional whose services match your objectives. For example, some financial planners will hand you a plan that you can implement on your own. Others, like our firm, offer ongoing financial planning and investment management meant to reach your goals.

When you locate a potential financial advisor, ask them how they get paid—whether they are commissioned, fee-based, or fee-only. You’ll want to drill down on how you will be charged. For example, you might pay:

- Flat annual fee

- Hourly rate

- Per project

- On retainer

- For assets under management

Most fee-only advisors, like our Kansas City, MO firm, offer the assets under management (AUM) model. This means your fees are based on a percentage of assets the advisor manages for you.

Ask for a potential advisor’s Form ADV and Form CRS, which break down the fees they charge. As a fee-only advisor, we strive to make our fees clear, and if you have any questions, we encourage you to ask us. We want you to understand how we get paid because your trust is essential to our relationship.

Our Comprehensive Services

Our advisory team of fee-only financial advisors provides personal financial planning and investment management designed to achieve your vision of prosperity.

The question we’ll ask you is “What does prosperity look like to you?” Your answer will become the foundation for your personalized Prosperity Planning Blueprint™. The blueprint is our structured process to uncover your financial obstacles and opportunities. It is comprehensive, integrating all areas of your personal finances.

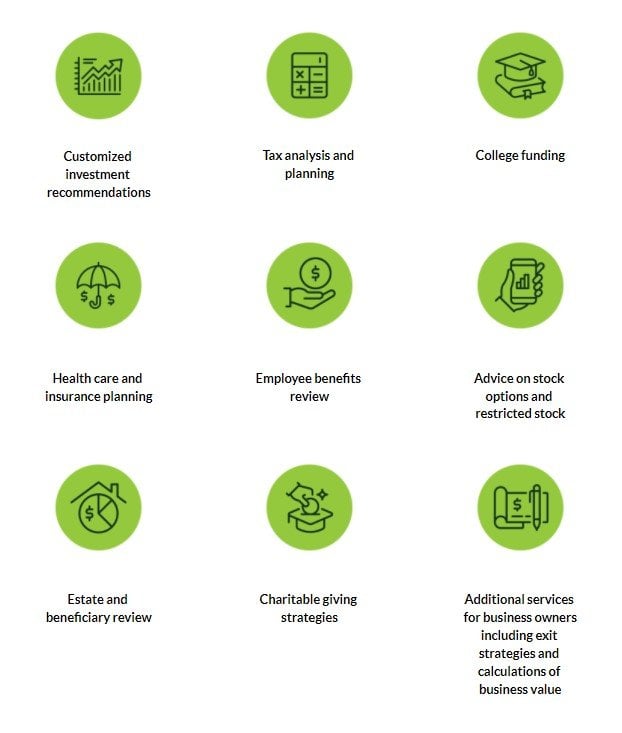

Blueprint topics include:

Your Prosperity Planning Blueprint™ will follow a fee-only model. We think serving as a fee-only advisory firm aligns our interests with yours even more.

How to Learn More About Fee-Only Advising

Fee-only financial advisors often join professional organizations that require members to be fee-only. These organizations can be a great resource for you in learning more about the fee-only model.

You can visit the websites for:

- National Association of Personal Financial Advisors (NAPFA): Check out the “Consumers” tab for helpful financial resources, such as “What Is Fee-Only Advising?” and “Fiduciary 101.” Use the Find an Advisor tool on the homepage to find a NAPFA-registered financial advisor near you.

- FeeOnlyNetwork.com: This website provides another resource for locating NAPFA members. You can get answers to such questions as “What Should I Look for When Choosing a Financial Advisor?”

- Garrett Planning Network: This organization was created to serve people from all walks of life, even if they don’t meet the minimum asset levels that many advisors require. In addition to searching for members, you can check out How to Choose an Advisor for questions to ask potential advisors.

- XY Planning Network: If you are a member of Generation X or Y, you can seek a financial advisor here with expertise in your needs. You can search by specialties, such as career stage, ethnicity or language focus, and interests and hobbies.

We also welcome the opportunity to answer any questions you may have about our fee-only services.

Get Started

What does your Prosperity Planning Blueprint™ look like? Schedule a 30-minute discovery call to discuss your situation and how we may be able to help.

SCHEDULE A DISCOVERY CALL

Let’s discuss how your personalized Prosperity Planning Blueprint™ can reduce complexity, lower taxes, and lessen the responsibilities that come with success. Schedule a complimentary 30-minute call below.