Dan Reiter, CFP®, CPA

Understanding business value is critical for every business owner. A fuller understanding of different methods used to value businesses and how will give you an upper hand in both knowing what factors buyers will perceive as detriments to value, as well as how to incorporate its value in your plan for selling your business. Every business value is unique and determined by each business’ unique characteristics and circumstances.

One brief comment.. Often, to their detriment, owners will rely too heavily on “rules of thumb” to determine value, such as a multiple of discretionary earnings. Most astute buyers do not rely on rules of thumb. As such, understanding how valuation professionals and other buyers measure value will serve to help you better understand your own business’ perceived risks in the marketplace, and minimize buyer concerns long before they occur.

Valuation Methods

There are three main methods used in the valuation field:

(1) the income approach

(2) the market approach, and

(3) the cost approach

The cost approach is largely used in bankruptcy, liquidation, and other settings where a business is not worth more than its assets. This approach involves adjusting balance sheet items to their market value and adding the value other intangible assets if they exist (i.e., goodwill). Given its limited usefulness and high cost to complete, however, the cost method is used less frequently. As such, we focus our attention on the two most highly utilized methods in measuring value for active successful businesses—the income and market approaches.

The Income Approach

The income approach results in a standard of value also known as a company’s intrinsic value. The income approach is calculated using a formula. The formula is a fraction with normalized cash flow in the numerator and the capitalization rate in the denominator. Furthermore, the capitalization rate is calculated by subtracting the company’s long-term expected growth rate on cash flows from the discount rate assigned by the investor/buyer.

A company’s discount rate is also known as the buyer’s required rate of return. In any type of equity investment, a buyer will require a certain return based upon their perceived risk of their investment. There is a direct correlation between the perceived risk and required return, meaning the discount rate and demand for return will be higher if the perceived risk is higher.

The discount rate is arrived at by a combination of both a risk-free rate and risk premiums. The risk-free rate is a measure of return that an investor can expect to receive on their dollars for little to no risk. Usually, a 20-year Treasury bill rate is used. As of the time of this writing in mid-2021, this rate is about 2%.

Next, risk premiums must be added to the risk-free rate. First, a market risk premium must be added. This market risk premium is equivalent to the higher return that can be earned by a diversified portfolio of equities (usually publicly traded companies). Let’s say this premium is an additional 7%. If a buyer can expect to earn 9% on a diversified portfolio of publicly traded companies, they would be crazy to accept a return for one private company that is less than this amount – no matter how well it is ran!

Finally, there are two other risk premiums to account for at the company level. First, there is size risk. Aspects such as lower access to capital and funding, lower diversification in product lines, as well as other systematic risk components unique to smaller companies exist. By and large, a company with $100 million in revenues will usually be deemed less risky than a company with $2 million in revenues—insofar as size is concerned, anyway. Second, there is a company specific risk premium.

There is both good news and bad news related to the company specific risk premium. The bad news is that this premium has the widest range of potential outcomes. It could be 0%, or it could be 30%. Or, it could be much higher in the case that there is no value separable from the business owner herself. The good news? This is also the premium where you as the business owner have the greatest level of control. With intentional focus on the factors that may impact your company specific risk premium, you can significantly increase value by focusing on your company specific risk factors—with no change to cash flow!

To illustrate the income approach, let’s say Company A has cash flows of $5 million and a long-term expected growth rate of 3%. Its discount and capitalization rates are calculated as follows:

Company A’s intrinsic value under the income approach is approximately $21.7 million ($5 million divided by .23).

The Market Approach

The market approach is based on the premise that the value of a business can be determined by a review of sales of reasonably comparable companies that have taken place in the public or private marketplaces. This is an approach that is often used in the world of real estate appraisals. A real estate appraiser will start with a review of sales activity in your area for homes that are like yours. Likewise, similar databases exist for transactions in small companies.

The main advantage of the market approach is in its simplicity. It is simple to understand, apply, and is data driven. The main disadvantage, however, is data quality and the existence of sale transactions for truly comparable companies. In many cases, the data that exists is either too incomplete to be meaningful, or an owner’s company is simply too unique to be comparable.

If comparable companies (called guideline companies) are found and selected, the person performing the valuation calculation will determine the pricing multiples in their review of the transactions in aggregate. A pricing multiple relates the sale price of a similar company (or several similar companies) to cash flow or another benefit measure.

The pricing multiple is what investors are willing to pay for a certain level of sales, income, and assets. One thing is clear: this is where all companies are not held equal. First, the industry within which the business operates matters. Accounting firms often trade at much lower multiples than software or technology companies, for example. Also, two businesses can have an identical level of revenue in the same industry yet have significantly different values due to their multiple being higher or lower. Risk, once more, plays the single most important role in determining what multiple your business will sell for.

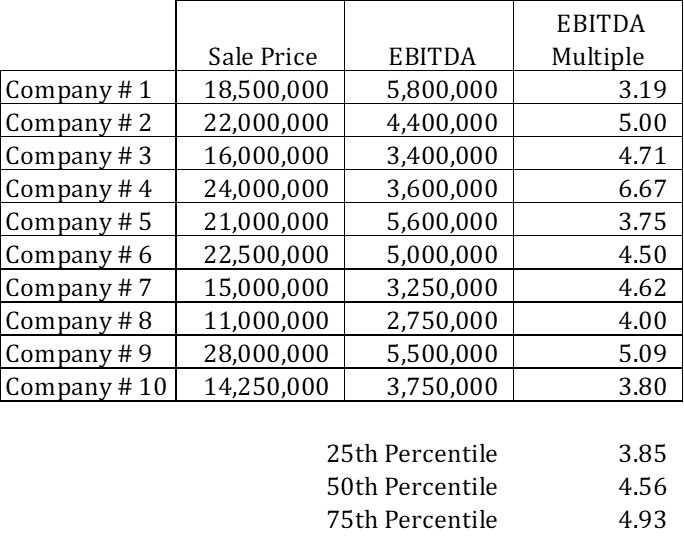

Let’s say a business valuation expert finds the following comparable transactions in a review of sales data:

NOTE: The benefit measure used is EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization. EBITDA is a commonly used benefit used in business valuations.

If Company A’s EBITDA is $5,000,000, based on the comparative sales data, it stands to reason that its value range is likely somewhere between $19.2 million (25th percentile) and $24.6 million (75th percentile). Once more, the company’s specific risk factors will determine the appropriate multiple to use. If the valuation professional determines that Company A’s specific risk factors place it in the middle of all those companies sampled, for example, the 4.56 multiple of EBITDA may be most appropriate – yielding a valuation of $22.8 million.

Conclusion

Two elements, above all else, stand out as the most critical in valuing a business. The elements of value of a business are cash flow and risk.

Cash flow is often the best measure of return because it is what creates the spending power and return to the buyer. There have been plenty of companies showing positive income on their profit and loss statements that went out of business. The same cannot as frequently be said, however, for companies that have strong cash flow. Business owners are used to focusing on cash flow and their profit & loss statements. Often, however, we see business owners place far too little emphasis on risk.

One of the most referenced guides on business valuation, the IRS’ Revenue Ruling 59-60, defines valuation as “in essence, a prophesy as to the future”. Buyers will also make prophesies when they look to make purchase decisions. They will weigh the likelihood of achieving their projected financial results based upon certain risks. The best business owners learn to be able to objectively view their businesses from the outside looking in to root out these issues and barriers to increased value.

If you are interested in a deeper understanding of your own company’s specific risk factors, we recommend that you get a valuation from a professional that also includes value-enhancing insights, such as our Business Blueprint process.